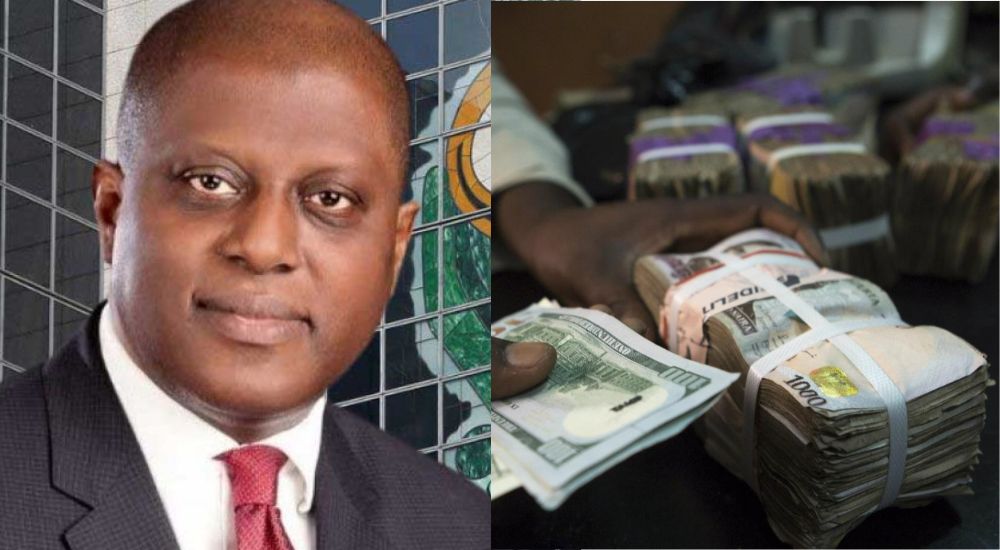

In September 2024, the Central Bank of Nigeria (CBN) took decisive action to stabilize the foreign exchange (FX) market by selling a total of $543.5 million to authorized dealer banks. This intervention occurred between September 6 and September 30, aiming to mitigate the market volatility that arose from rising demand for foreign currency, particularly due to commodity imports and seasonal economic pressures.

The Nigerian economy has been facing significant challenges due to increased demand for foreign currency. This demand has been driven by various factors, including

Nigeria relies heavily on imports for various essential goods, which has led to a surge in demand for foreign exchang

Certain times of the year see increased economic activities, further heightening the need for FX to facilitate trade.

In response to these challenges, the CBN intervened to ensure stability in the FX market, aiming to protect the Naira from excessive depreciation and maintain a balanced economic environment.

According to Omolara Duke, the Director of the Financial Markets Department at the CBN, these FX sales were conducted over 11 trading days using a two-way quote system. The transactions were settled under a T+2 arrangement, meaning that the currency exchange took place two business days after the trades were executed.

Here’s a detailed breakdown of the sales made during this period:

- September 6: $39 million sold at exchange rates between N1,580 and N1,605 per dollar.

- September 9: $66 million sold at rates between N1,570 and N1,585 per dollar.

- September 11: $77 million sold at rates between N1,540 and N1,575 per dollar.

- September 13: $46 million sold at similar rates.

- September 18: $24 million sold at rates between N1,530 and N1,540 per dollar.

- September 19: $28 million sold at rates between N1,540 and N1,555 per dollar.

- September 20: $31 million sold at rates between N1,540 and N1,545 per dollar.

- September 23: $17.5 million sold at a fixed rate of N1,540 per dollar.

- September 26: $80 million sold at rates between N1,570 and N1,580 per dollar.

- September 27: $79 million sold at rates between N1,530 and N1,580 per dollar.

- September 30: $56 million sold at a rate of N1,540 per dollar.

The CBN emphasized that this information is meant to guide the public on FX pricing by providing insight into the rates at which currency was sold to authorized banks. By releasing these details, the CBN aims to increase transparency in the FX market, allowing traders and businesses to make informed decisions based on current exchange rates.

This latest sale follows a significant transaction in August 2024, when the CBN sold $876.26 million at a rate of N1,495 per dollar. Earlier, in late July, the CBN had also sold $148 million in the foreign exchange market over two trading days. These previous interventions reflect the CBN’s ongoing efforts to maintain stability in the FX market and address the rising pressures on the Naira.

The CBN has reiterated its commitment to supporting the flow of foreign exchange into Nigeria’s market as part of its comprehensive FX management strategy. The bank is continuously monitoring market conditions and remains prepared to intervene whenever necessary to ensure the stability of the Naira and the overall economy.

In conclusion, the CBN’s recent intervention by selling $543.5 million is a clear indication of its proactive approach to managing the FX market in Nigeria. By addressing market volatility and ensuring adequate foreign currency supply, the CBN aims to foster economic stability and support sustainable growth in the country.