Nigerians have begun raising concerns over what they describe as double stamp duty charges by banks, just days after the new tax laws took effect. The policy introduced a uniform ₦50 stamp duty charge on electronic transfers of ₦10,000 and above, and banks notified customers about the new deductions through emails and alerts. However, many customers now say they are seeing higher deductions than expected.

Several bank users complained that instead of ₦50, they were charged ₦100 for a single transfer. Some described the deductions as unfair, especially given the current economic challenges in the country. A few customers also threatened to report their banks or take legal steps if the extra charges continue.

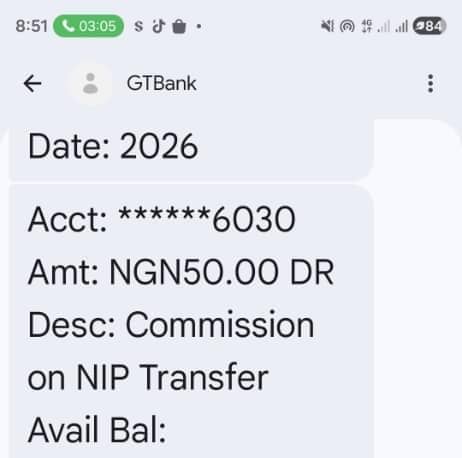

However, a university lecturer, Professor Godwin Oyedokun, explained that what many people see as double stamp duty may actually be a combination of different charges. He said that aside from the ₦50 stamp duty, banks also charge a ₦50 fee for NIP transfers, which together appear as ₦100. He advised Nigerians to check their transaction breakdown carefully before concluding that banks are overcharging.

Meanwhile, the Central Bank of Nigeria has not issued any official response to the complaints, while consumer groups are still reviewing the situation. The controversy adds to earlier debates surrounding the new tax reforms, which have faced criticism and public scrutiny since they were introduced, despite government assurances that the reforms are in the public interest.