Concerns that artificial intelligence (AI) could render traditional digital service models obsolete are driving a pronounced market rotation in 2026, as investors rebalance portfolios toward hard assets and companies perceived as less vulnerable to technological disruption.

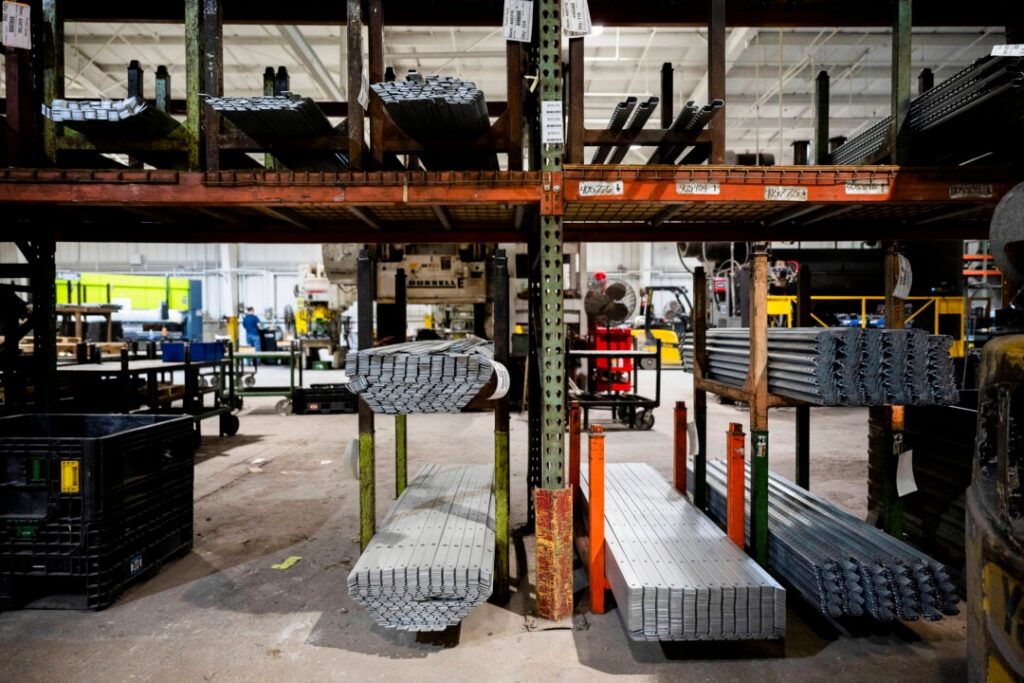

After more than two years of enthusiasm for AI-linked growth stocks, capital is shifting away from enterprise software and digital service firms and into sectors tied to physical assets and essential demand, including energy, materials, industrials, and utilities.

Analysts say the move reflects both a reassessment of AI’s disruptive reach and broader macroeconomic uncertainty.

Market Rotation Gains Momentum

Recent market performance underscores the shift.

Innovation-focused funds and high-growth digital companies have come under pressure. Cathie Wood’s ARK Innovation ETF has declined 9.72 percent year to date. Adobe is down 25 percent, Salesforce 30 percent, and Atlassian nearly 50 percent. The Nasdaq Composite, long home to high-growth technology firms, has slipped 3 percent year to date following years of outsized gains.

In contrast, hard-asset sectors have rallied. The Vanguard Materials Index Fund ETF Shares is up 15 percent year to date, while the State Street Energy Select Sector SPDR ETF has gained 20 percent and the State Street Utilities Select Sector SPDR ETF has advanced 22 percent.

Industrial bellwethers have also posted strong gains, with Caterpillar up 33 percent, Deere & Company 29 percent, Honeywell International Inc. 24 percent, and Boeing 12 percent. The Dow Jones Industrial Average has risen 2.68 percent.

Market strategists say the divergence highlights growing caution toward business models that could be reshaped by AI.

David Russell, global head of market strategy at TradeStation, said uncertainty around monetary policy is amplifying risk aversion. Minutes from the Federal Open Market Committee released on Feb. 18 revealed divisions within the Federal Reserve over inflation and interest-rate policy, clouding the outlook for the remainder of the year.

“Policymakers are split on inflation and interest-rate policy, struggling to reach consensus,” Russell said, noting that such divisions tend to dampen appetite for riskier assets, including unprofitable digital companies.

Repricing Digital Risk

Analysts say the shift reflects a broader repricing of digital risk as investors reassess which companies stand to benefit from AI and which may be displaced.

Michal Prywata, co-founder of Vertus, said capital is moving toward businesses that AI cannot easily replicate.

“If people are unsure who AI disrupts or will disrupt most, money moves into more physical sectors like power, energy, materials, industrial infrastructure, and staples, while fee-based, people-heavy services get repriced,” he said.

AI systems, which perform cognitive tasks traditionally handled by humans, are often compared to the automation revolution. Unlike automation, which primarily replaced manual labor, AI targets mental tasks, potentially reshaping enterprise software, real estate management, and investment services.

For much of the past two years, Wall Street concentrated on perceived AI beneficiaries such as Nvidia, AMD, and Oracle. More recently, investor attention has turned to sectors vulnerable to disruption, reinforcing the move toward hard assets.

Valuation disparities further illustrate the divide.

Palantir trades at a forward price-to-earnings ratio of 178, while Applied Digital trades at 526. By comparison, Caterpillar’s forward P/E stands at 26, Deere & Company’s at about 22, and Honeywell’s at 18.

Phil Santoro, co-founder of Wilbur Labs, said the rotation reflects growing skepticism toward companies that overstate their AI credentials.

“Markets are increasingly favoring businesses with durable competitive advantages that cannot be easily replicated through technology alone,” he said.

Eugenia Mykuliak, founder and executive director of B2PRIME Group, said the trend also mirrors typical capital cycles following rapid sector gains.

“Investors are moving past the bold ‘energy’ of the AI topic and are now looking at the promise and profitability of such companies more objectively,” she said.

Thomas Drury, co-founder and senior trading analyst at The Investors Centre, described the shift as a long-overdue repricing driven by higher capital intensity, uncertain payback periods, and reduced earnings visibility in digital sectors.

Structural Shift or Temporary Rotation?

Whether the trend signals a lasting regime change remains an open question.

Drury said elevated AI capital expenditures, uneven earnings distribution, and structurally higher interest rates could extend the rotation, as investors favor companies with stronger near-term cash flow and clearer earnings visibility.

“If tech earnings accelerate again or if interest rates decline substantially, then this is merely a rotation, not a new market regime,” he said.

Market observers note that asset repricing is a normal feature of equity markets, as capital shifts across sectors rather than exiting equities altogether.

Santoro compared the current environment to previous technology cycles, arguing that long-term winners will be companies that apply AI to solve practical, high-cost problems rather than rely on hype.

Niraj Jha, a senior logistics and operations leader, said AI is likely to reorder value across sectors rather than permanently tilt markets toward physical assets.

“As AI tools become commoditized, competitive advantage will depend more on execution, data integration, and operational depth,” Jha said. “Some software companies with shallow integration may see prolonged multiple compression, while deeply embedded enterprise platforms could reaccelerate as they become the primary control planes for AI-driven decision-making.”

Analysts broadly agree that the market’s reassessment reflects a maturing view of AI—one that may reshape sector leadership but is unlikely to eliminate digital business models altogether.