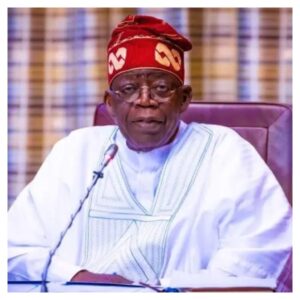

The Federal Government has announced that its newly issued ₦501 billion power sector bond has achieved full subscription, showing strong investor confidence in Nigeria’s electricity reform efforts. The bond was issued under President Bola Tinubu’s Power Sector Debt Reduction Programme to address long-standing debts in the electricity industry.

According to the government, pension funds, banks, asset managers and other investors showed massive interest in the bond. Speaking at the signing ceremony in Lagos on January 27, 2026, the President’s Special Adviser on Energy, Olu Verheijen, described the outcome as a major turning point for the Nigerian Electricity Supply Industry (NESI). She said the programme is designed to clear legacy debts, restore liquidity and rebuild confidence in the power market.

Verheijen explained that the Series 1 Power Sector Bond, issued through NBET Finance Company Plc, closed at ₦501 billion. This included ₦300 billion raised from the capital market and ₦201 billion allotted to power generation companies. She noted that the strong uptake reflects growing trust in the government’s reform agenda and commitment to fixing structural problems in the sector.

She added that five power generation companies, covering 14 power plants nationwide, have already signed settlement agreements with the Nigerian Bulk Electricity Trading Plc (NBET). The total agreed settlement is ₦827.16 billion, to be paid in phases. Proceeds from the bond will fund the first payments, helping to ease tensions caused by unpaid debts that once threatened the stability of the power sector.