A Lagos High Court has issued an arrest order for Access Bank CEO Bolaji Agbede and other senior officials over allegations of fraud linked to a loan agreement.

Security agents reportedly visited the bank’s headquarters on February 5, 2025, to enforce the order.

The case involves a N333 million loan given to Balmoral International Limited by Diamond Bank (now Access Bank).

MOB Integrated Services Limited had provided their property in Ikoyi as collateral for this loan. However, Access Bank later used the same property as collateral for a separate N1 billion loan—without MOB Integrated Services’ consent.

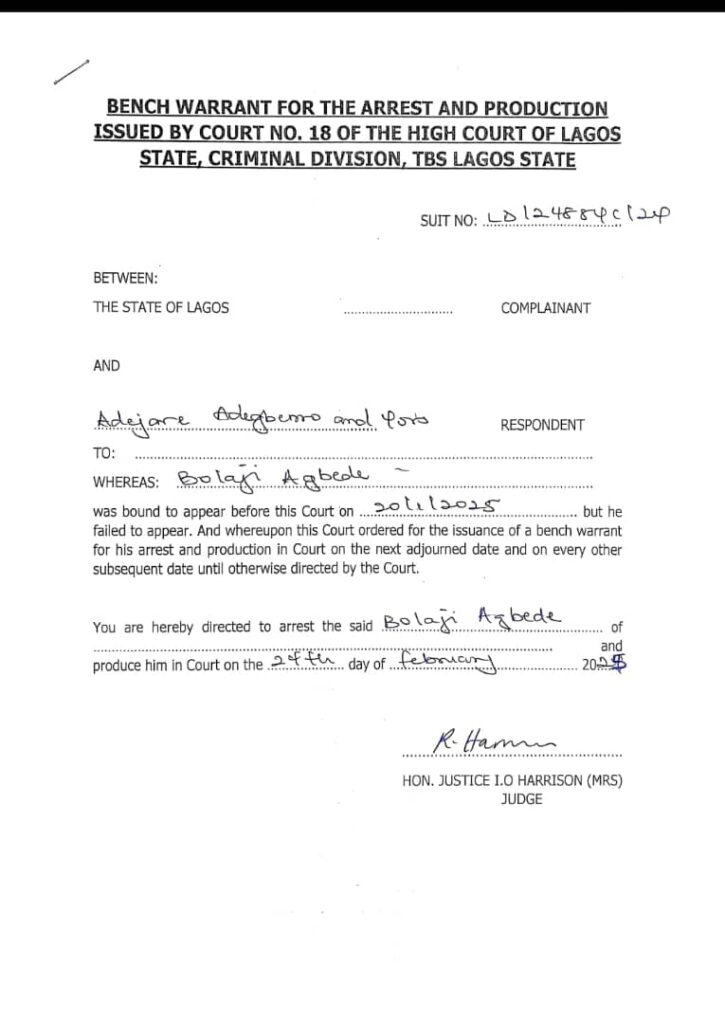

When the bank officials failed to appear in court as required on January 20, 2025, Justice Ibironke Harrison issued a Bench Warrant for their arrest.

Police officers, led by an Assistant Commissioner of Police, arrived at the bank’s headquarters on February 5 to carry out the arrest.

However, they were informed that the CEO was in a meeting, while the Company Secretary was in London. After discussions with the bank’s legal team, the police were assured that the accused individuals would appear in court on February 24, 2025.

The Lagos State government has filed a four-count charge against Access Bank, its CEO, and other individuals involved.

The case, identified as LD/24884C/2024 – The State of Lagos v. Adejare Adegbenro & Others, will proceed on February 24, 2025.

This case highlights the Nigerian government’s continued fight against financial fraud in the banking sector. Authorities are keen on holding responsible parties accountable for misconduct.