Nigeria’s inflation rate has dropped for the fourth month in a row, but the reality for citizens and business owners has not improved. Daily life remains tough as food, fuel, and transport prices continue to rise despite the official numbers showing progress.

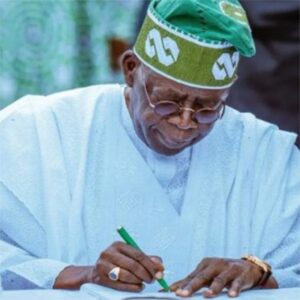

According to INFOLAND, inflation eased to 21.88 percent in July from 22.22 percent in June. This downward trend started in April 2025 when inflation was 23.7 percent. The Tinubu administration has celebrated these figures, calling them proof of economic progress under the president’s leadership.

The country’s economy has also been boosted on paper, with Nigeria’s Gross Domestic Product rising to N372.8 trillion in 2024 after a rebase in July 2025. Similarly, inflation was rebased in January, lowering the official yearly rate to 24.48 percent from 34.80 percent.

Former Finance Minister Ngozi Okonjo-Iweala even remarked that the economy is stabilizing during her recent meeting with President Tinubu.

But while the numbers look good, Nigerians are facing worsening conditions. Food prices, high interest rates, expensive energy, and skyrocketing transport fares have made life harder. For instance, a 50kg bag of local rice now costs between N69,000 and N75,000 in Abuja and Lagos.

Fuel sells at N865 to N925 per litre, cooking gas ranges from N1,000 to N1,200 per kilogram, and electricity tariffs sit between N209.50 and N231.79 per kWh. Both road and air transportation costs are also climbing fast.

Experts are divided on what these inflation figures really mean. Mazi Okechukwu Unegbu, former president of the Chartered Institute of Bankers of Nigeria, dismissed the numbers as unrealistic, saying they do not match what Nigerians are experiencing. He argued that the government is focused on reports instead of solving hunger and economic hardship.

Gbolade Idakolo, CEO of SD & D Capital Management, explained that food inflation continues to rise because of insecurity in farming areas and exchange rate problems.

He also blamed high transport and energy costs for pushing food prices up. The Centre for the Promotion of Private Enterprise (CPPE) has echoed similar concerns, stressing that food costs remain high even as inflation officially drops.

Prof. Segun Ajibola, an economist and former CIBN president, added that the inflation rate is based on a basket of selected goods, meaning the drop may only reflect changes in a few items.

He warned that the figures may not capture the reality in all parts of Nigeria, since prices vary across locations and essential items outside the basket may remain expensive.

In the end, while government officials celebrate positive statistics, most Nigerians continue to feel the squeeze of a struggling economy.