President Bola Tinubu recently shared some important news about taxes that will make life easier for many Nigerians. He announced that rents, public transportation, and renewable energy will no longer have to pay Value Added Tax (VAT). This means these services will be cheaper for everyone.

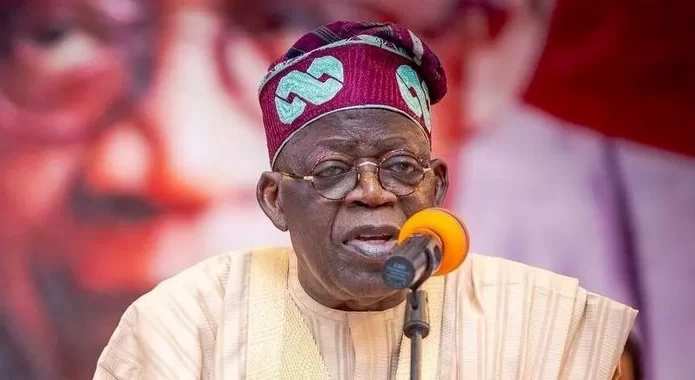

The President made this announcement during his speech celebrating two years in office. He said the government wants to reduce the financial burden on households. In addition to rents and transport, essential goods like food, education, and healthcare will now have 0% VAT, meaning no tax will be charged on these important items.

President Tinubu explained that this change is part of a bigger plan to improve the tax system in Nigeria. Over the past year, the government worked hard to increase the country’s tax income from 10% to more than 13.5% of the GDP. This success comes from better tax policies that aim to be fairer and help the economy grow.

One key goal is to help small businesses by removing unfair multiple taxes. This will make it easier for these businesses to grow and become official parts of the economy. The new tax rules will also protect low-income families and workers by allowing them to keep more of their money. By making essentials like food, healthcare, education, rent, and transport free of VAT, the government hopes to lower living costs even more.

The President also said that Nigeria will stop wasting money on unclear tax breaks. Instead, the government will focus on supporting important sectors like manufacturing, technology, and farming through clear incentives. This approach will not just increase government revenue but will help the entire economy grow more fairly.

There is special attention on young people, especially those working in digital and remote jobs, who will benefit from friendlier tax rules. Nigerian businesses will also get help to sell their goods around the world through export incentives. The National Single Window project will make international trade faster and easier, improving Nigeria’s competitiveness.

To make the tax system even fairer, a new office called the Tax Ombudsman will be created. This independent institution will protect small businesses and vulnerable taxpayers, making sure the tax system works well for everyone.

Finally, the government is working on a new national fiscal policy. This will guide how Nigeria manages taxes, borrowing, and spending in a responsible way to build a strong and sustainable future.

These tax reforms aim to reduce the cost of living, create a fairer economy, and build a business-friendly environment that attracts investment. President Tinubu’s vision is for a Nigeria where everyone shares in progress, and no one is left behind.