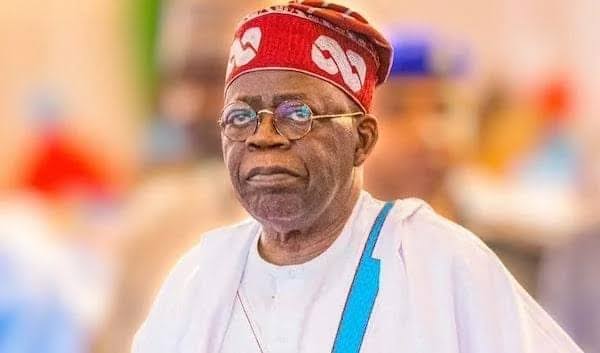

President Bola Tinubu has introduced four new tax reform bills to Nigeria’s House of Representatives, requesting their speedy approval. The President’s message, delivered by Speaker Abbas Tajudeen during a plenary session on Thursday, highlighted that the bills were developed in line with his administration’s goals of improving Nigeria’s financial systems.

The first of the proposed laws is the Nigeria Tax Bill 2024. This bill is designed to provide a framework for the country’s tax policies and to ensure a well-structured tax system.

The second is the Tax Administration Bill. This aims to create a clear legal structure for managing all taxes across the country, helping to reduce confusion and prevent tax disputes.

The third bill, Nigeria Revenue Service Establishment Bill, aims to replace the existing Federal Inland Revenue Service with a new body called the Nigeria Revenue Service. The goal of this reform is to improve tax collection efficiency and modernize Nigeria’s tax administration.

Lastly, the Joint Revenue Board Establishment Bill proposes the creation of a tax tribunal and a tax ombudsman. These institutions will be responsible for resolving tax disputes and ensuring fairness in tax matters.

Tinubu believes that these bills, once passed, will strengthen the country’s financial systems and support the government’s broader objectives of boosting transparency and efficiency in tax administration. The new laws are expected to help build a more effective and accountable tax structure in Nigeria.